Despite significant technological advances, robotic adoption in the inspection and maintenance (I&M) market is experiencing unexpected slowdowns, with many companies reverting to traditional methods. The fundamental issue? New robotic solutions need to deliver a 10x improvement over conventional approaches to gain meaningful traction.

During a visit to a large industrial complex in Germany, I experienced firsthand the resistance to robotics adoption. Sitting in a meeting room with the customer’s team, I began my well-rehearsed robotics pitch. The customer quickly interrupted, raising objections: “We don’t have qualified enough people,” “Our inspection pipeline is already backed up six months,” “Who will certify these inspections?”, “Our inspection budget doesn’t allow for this.”

After 45 minutes of this pattern, I changed tactics: “Look, I’ve heard all these reasons many times. Let’s switch roles. I’ll list all the objections I’ve encountered, and you try to convince me that automation and robotics is the right way forward.”

The customer was momentarily stunned, then smiled. This role reversal led to a productive conversation that revealed the true barriers to adoption, and it confirmed my belief that solutions need to be dramatically better, not just marginally improved, to overcome organizational inertia.

A 10% boost in productivity or uptime sounds appealing in a pitch deck, but on the ground floor of industrial operations, it rarely justifies the immense effort, cost, risk, and disruption involved in changing deeply ingrained workflows. The inertia is significant, and the perceived benefits often don’t outweigh the switching pain. Market data confirms the hesitation: inspections robots still grow at a healthy 14‑21 % CAGR, yet that growth is materially slower than forecast three years ago; surveys of robot buyers list integration complexity, cost and manpower shortage as the top barriers.

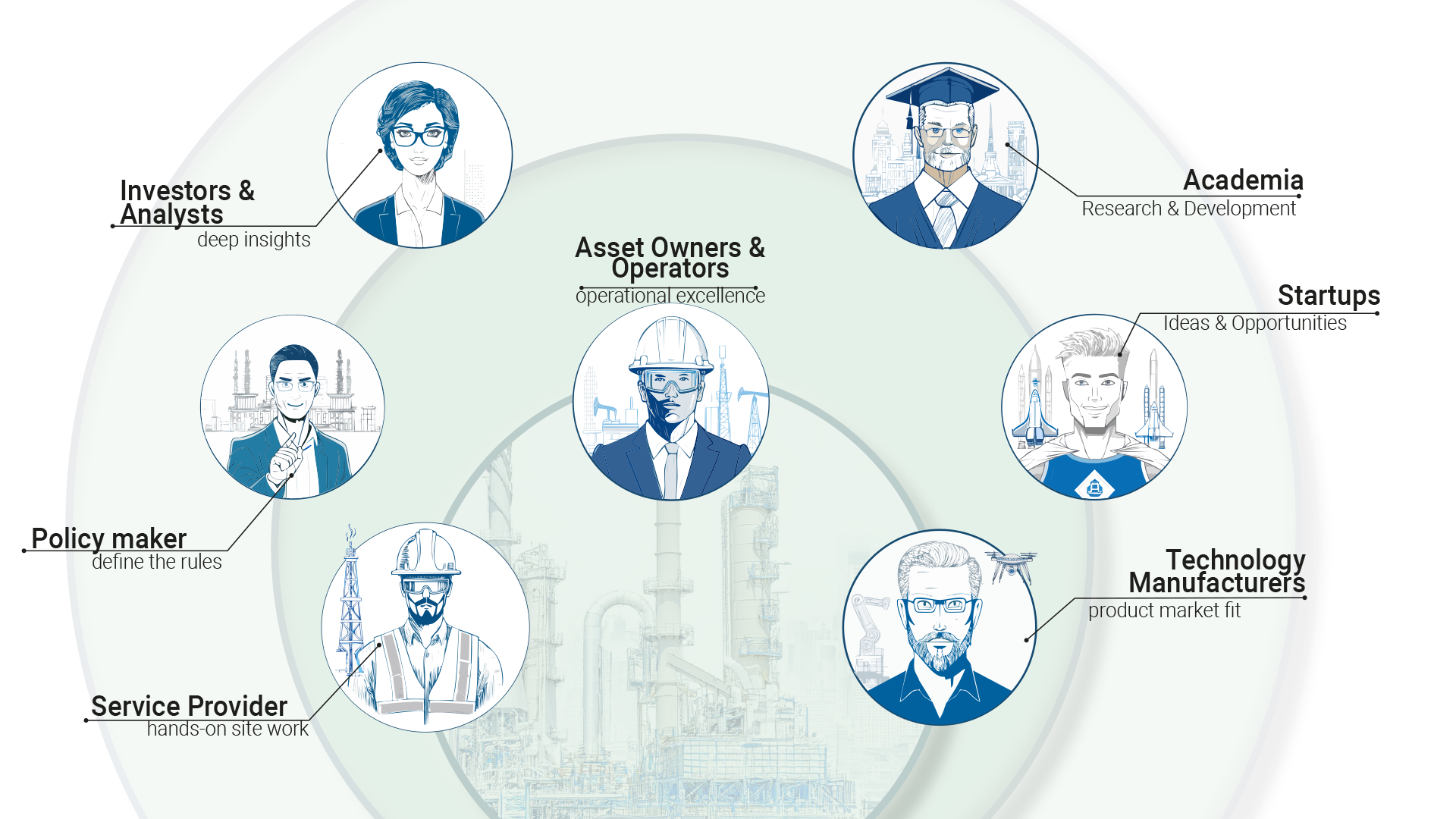

The Ecosystem

Players in the I&M Robotics market and their challenges

Asset Owner & Operators

For asset owners, inspection and maintenance represent a necessary evil. Their primary concern is obtaining regulatory approval at minimal cost to continue operations. While some forward-thinking owners seek additional data to optimize asset management, extend equipment life, or reduce outage frequency, most prioritize cost-efficiency and minimal disruption.

Inspection Service Providers

These companies fundamentally sell qualified personnel on an hourly basis in a market characterized by thin margins and intense competition. The industry remains highly fragmented with numerous small local players operating alongside larger entities. Service providers typically adopt advanced inspection technologies either under pressure from asset owners or when they see potential for higher margins. However, they consistently struggle to adapt their business models to properly monetize the benefits robotics can offer.

Technology Providers

As a colleague aptly described, robotics startups often represent “a bunch of academics in a learning curve.” With few exceptions like Boston Dynamics, most robotics companies are relatively young and inexperienced in commercial applications. They frequently develop impressive technologies that fail to meet real-world requirements like rugged controls or certifications such as ATEX, UL, or CE. Additionally, creating intuitive interfaces that allow non-PHD field operators to effectively use these systems remains a significant challenge.

Breaking Through: The Success Stories

Despite these challenges, several companies have successfully crossed the chasm by delivering genuine 10x improvements:

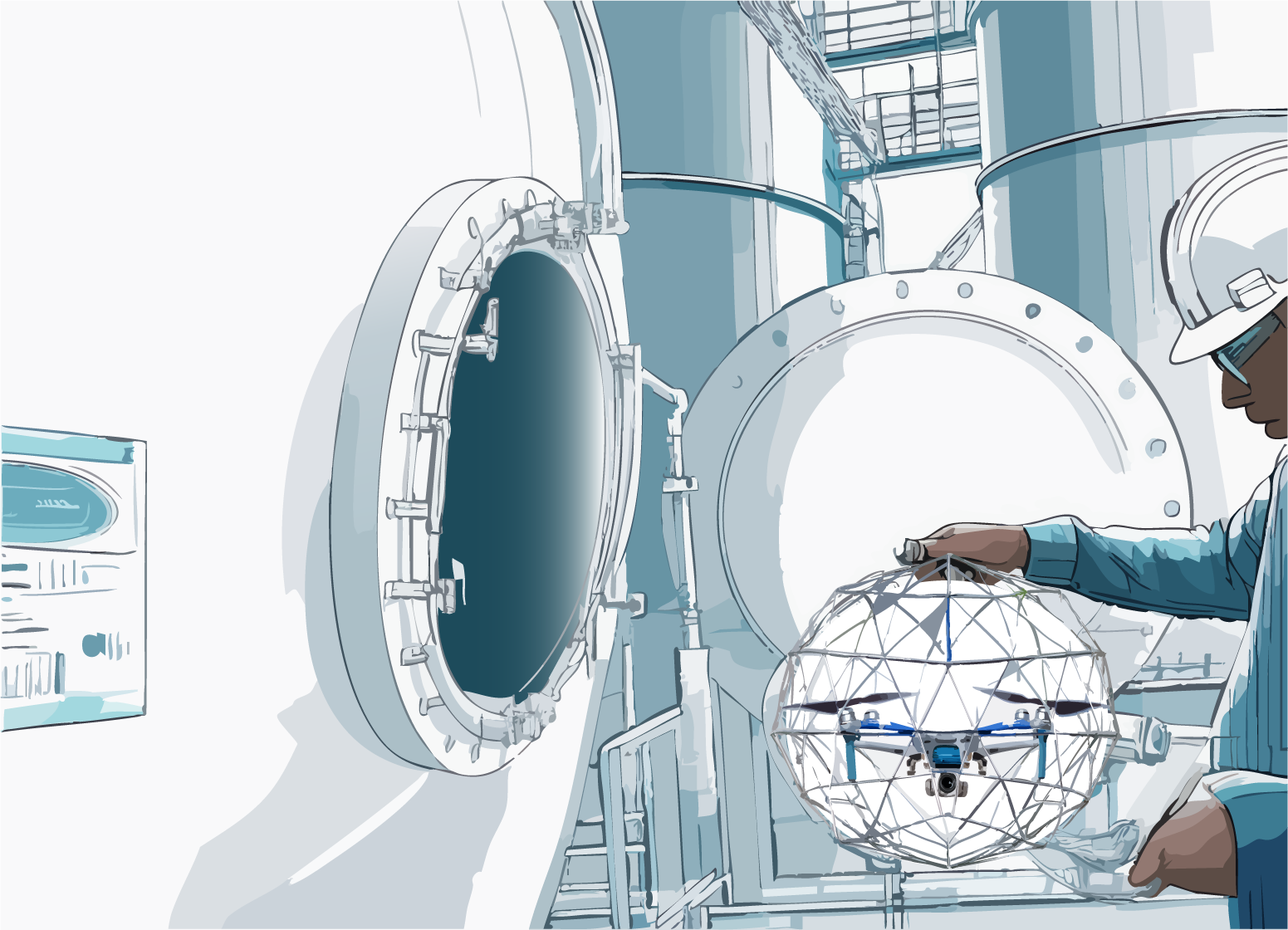

Flyability: Redefining Confined Space Inspection

drones for confined spaces

Flyability revolutionized confined space inspection with their collision-tolerant drones. Their success stems from solving a specific, high-value problem: eliminating the need for humans to enter dangerous confined spaces. The 10x improvement comes from dramatically reducing inspection preparation time (no scaffolding, no tank cleaning), eliminating safety risks to personnel, and cutting inspection downtime from days to hours. By focusing exclusively on confined spaces rather than attempting to be an all-purpose inspection drone, they created a solution that delivered order-of-magnitude improvements in both safety and economics.

Value: Safety + Speed + Cost Reduction.

Gecko Robotics: The Data-First Revolution

Gecko Robotics differentiated itself through a data-centric approach to industrial asset inspection. Their wall-climbing robots collect ultrasonic thickness measurements at densities hundreds of times greater than manual methods, creating comprehensive digital twins of critical infrastructure. The 10x improvement comes not just from the inspection efficiency but from the predictive capabilities enabled by their massive datasets. By applying machine learning to this unprecedented volume of consistent, high-quality inspection data, Gecko helps asset owners predict failures months in advance, optimize maintenance schedules, and extend asset lifespans significantly. Their business model innovation—selling outcomes and insights rather than just inspection services—has proved equally important to their technology advantages.

Value: Data Density + Speed + Predictive AI

ANYbotics: Autonomous Monitoring at Scale

ANYbotics found success with their quadruped robots by focusing on routine monitoring of industrial facilities. Their 10x advantage comes from consistent, 24/7 autonomous inspection capabilities in hazardous environments. The robots can perform rounds at frequencies impossible for human inspectors, detecting anomalies earlier through consistent measurement baselines. By integrating multiple sensor types (thermal, acoustic, visual) and developing sophisticated anomaly detection algorithms, ANYbotics delivers comprehensive condition monitoring that human inspectors simply cannot match in consistency or frequency. Their platform approach allows for continuous improvement of both hardware and AI capabilities over time.

Value: Automation + Data + Consistency

The Path Forward

Success in the industrial inspection robotics market ultimately requires identifying specific niches where order-of-magnitude improvements are achievable, then assembling cross-functional teams spanning asset owners (don’t forget operations personnel), service providers, and technology developers.

The winners in this space don’t just offer marginally better technology, they deliver comprehensive solutions that fundamentally transform specific inspection and maintenance activities with improvements so substantial that the resistance to change simply crumbles.

The question for aspiring robotics companies isn’t whether their technology is better than current methods, but whether it’s 10x better in ways that truly matter to all stakeholders in the complex industrial inspection ecosystem.