The Industrial Technology Startup Paradox: Why 90% Fail and How the 10% Thrive

The industrial technology startup landscape presents a fascinating contradiction. While breakthrough innovations in robotics, AI, and automation promise to transform manufacturing and industrial operations, the vast majority of startups pursuing these opportunities never reach their potential. Our analysis of over 500 industrial technology ventures reveals why this paradox exists and, more importantly, how forward-thinking entrepreneurs can position themselves among the survivors.

The Brutal Mathematics of Startup Success

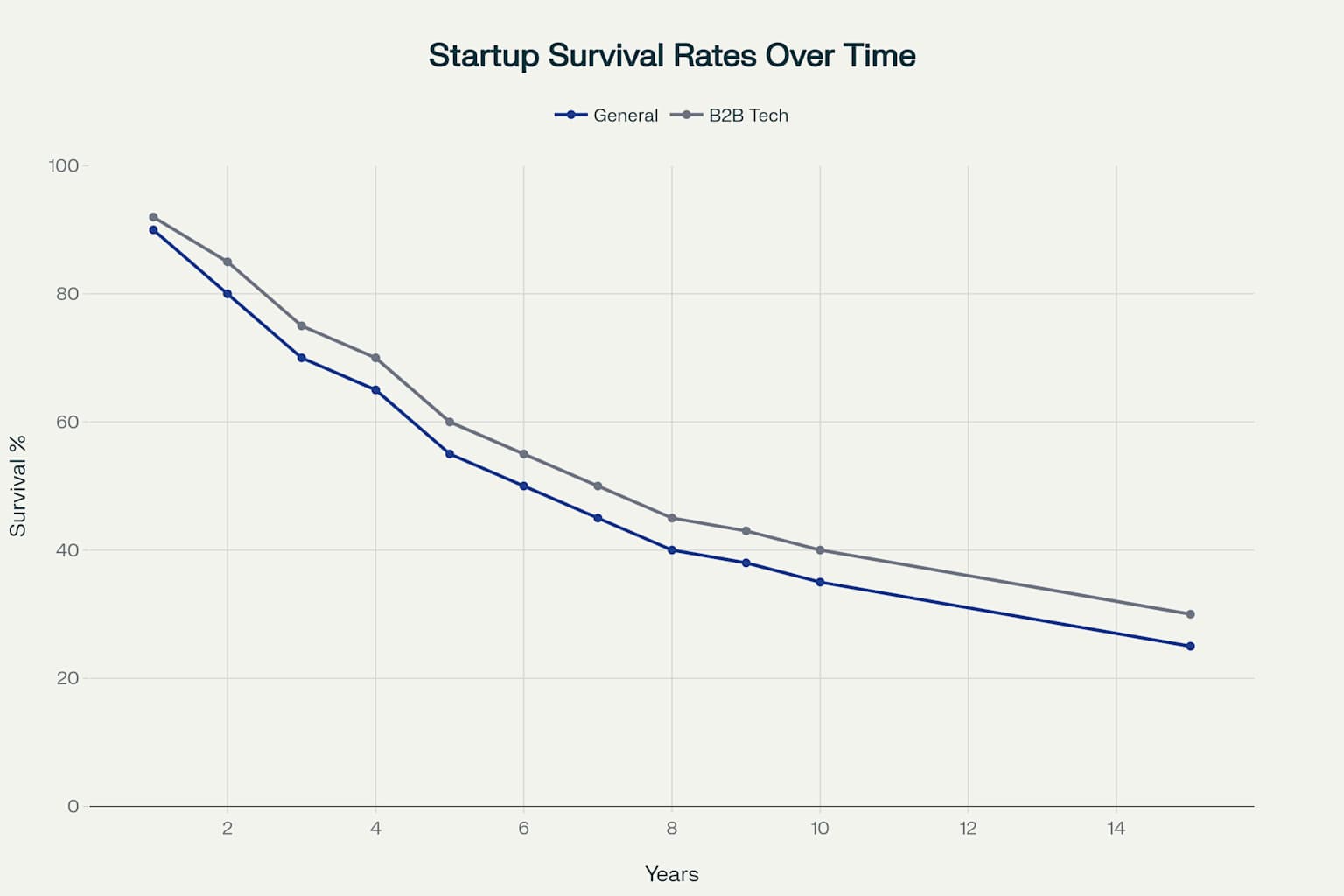

The statistics surrounding startup survival are sobering, particularly in the technology sector where failure rates exceed 90% over a 15-year period. However, these numbers tell only part of the story. When we examine industrial B2B technology startups specifically, we observe marginally better survival rates, suggesting that certain market characteristics provide protective factors for companies that understand how to leverage them.

Startup survival rates decline dramatically over time, with only 25% of general startups surviving 15 years, though B2B tech startups show slightly better resilience

The data reveals a critical inflection point between years two and five, where the majority of technology startups either achieve sustainable traction or face inevitable closure. For industrial technology companies, this period coincides with the lengthy B2B sales cycles and complex implementation requirements that characterize our sector.

Why Industrial Technology Startups Fail: Beyond the Surface Metrics

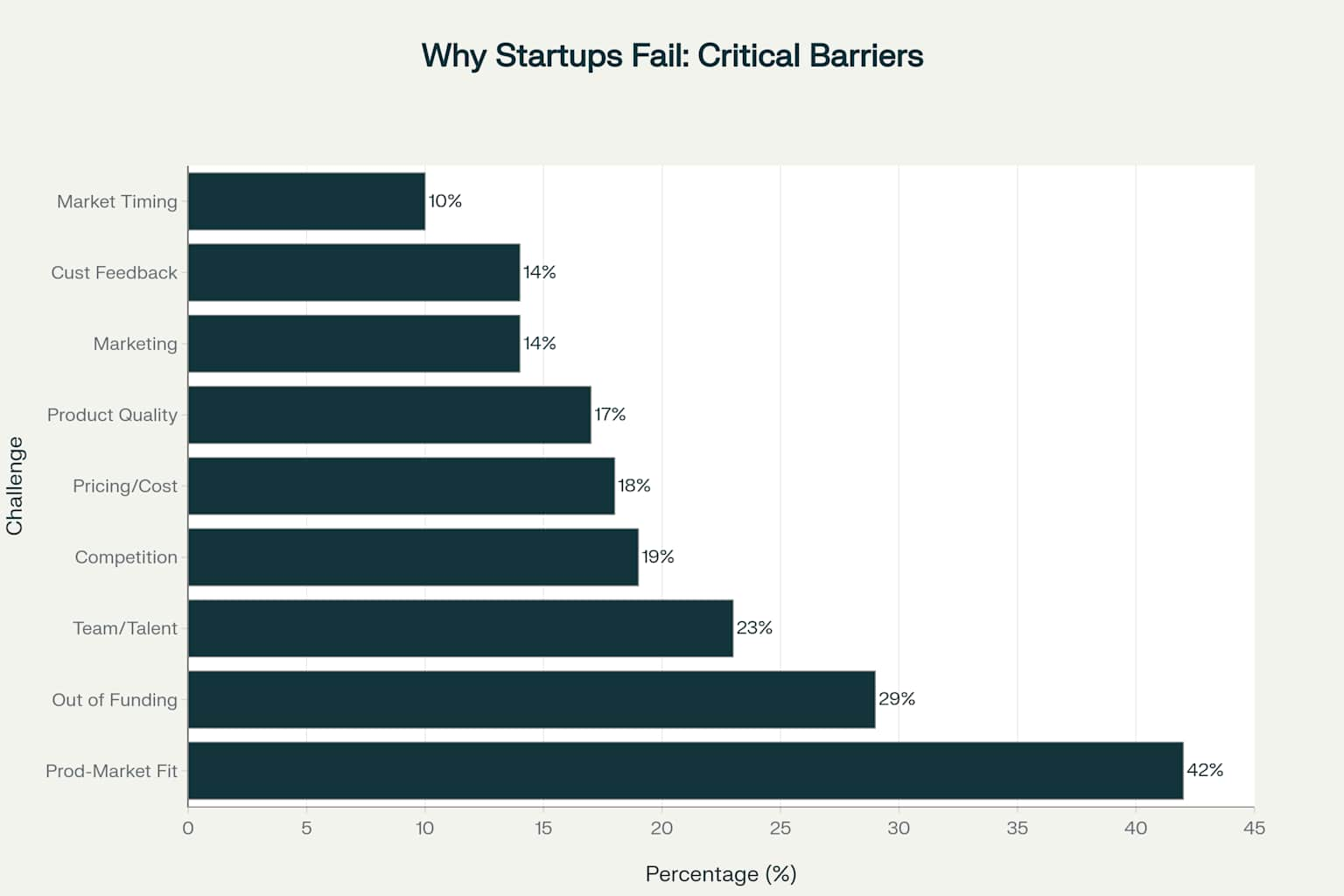

While conventional wisdom attributes startup failure to funding shortages or competitive pressures, our research into industrial technology ventures reveals more nuanced failure patterns. The leading cause remains the fundamental disconnect between technological capability and market demand, what we term the “solution-first fallacy”.

Product-market fit emerges as the leading cause of startup failure at 42%, followed by funding challenges at 29%

In the industrial technology space, this manifests as PhD-level engineering teams developing sophisticated solutions for problems that either don’t exist at sufficient scale or aren’t prioritized by asset owners and service companies. We’ve observed countless robotics and automation startups that excel at technical demonstrations but struggle to articulate why a facility should disrupt proven processes for marginal improvements.

The second-most critical failure factor, running out of funding, often stems from misjudging the extended timelines required for industrial technology adoption. Unlike consumer technology, where user adoption can occur within weeks, industrial implementations frequently require 18-36 months from initial contact to full deployment.

The 10X Improvement Threshold: A Market Reality

Through our work with asset owners across oil&gas, power, and infrastructure sectors, we’ve identified what we call the “10X improvement threshold”. This principle suggests that industrial technology adoption accelerates dramatically when solutions deliver order-of-magnitude improvements rather than incremental gains.

Consider the trajectory of industrial inspection robotics. Early iterations that improved inspection speed by 20-30% struggled to gain traction because the value proposition didn’t justify the complexity of implementation. However, solutions that reduced inspection time by 80% while simultaneously improving accuracy and safety began achieving rapid adoption.

This threshold exists because industrial decision-makers must account for implementation risks, training requirements, and operational disruption. Incremental improvements rarely justify these costs, but transformative capabilities create compelling business cases that drive adoption decisions.

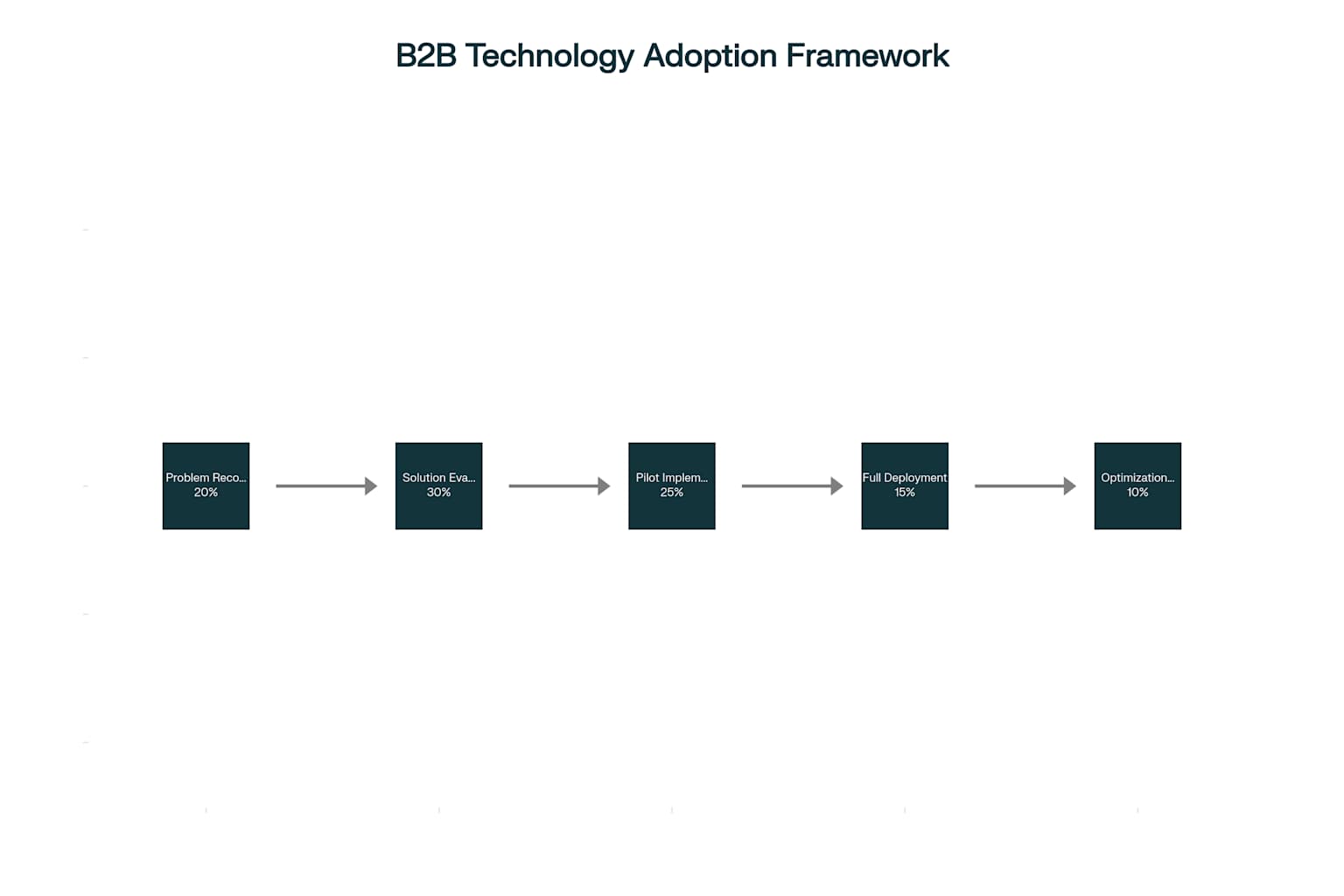

The B2B Technology Adoption Framework: Understanding Your Market’s Journey

Industrial technology startups often underestimate the complexity of their customers’ adoption processes. Asset owners and service companies follow predictable patterns when evaluating new technologies, and understanding these stages is crucial for startup success.

The B2B technology adoption process spans five critical stages, with solution evaluation taking the most time at 30% of the adoption timeline

The framework reveals why so many promising technologies fail during the solution evaluation phase, which consumes 30% of the adoption timeline. This extended evaluation period reflects the high-stakes nature of industrial technology decisions, where implementation failures can result in safety incidents, production downtime, or regulatory violations.

Successful industrial technology startups align their go-to-market strategies with this adoption framework. They invest heavily in problem validation before developing solutions, recognizing that customer development-led growth provides sustainable competitive advantages.

Strategic Growth Approaches for Industrial Technology Startups

Based on our analysis of successful industrial technology ventures, we’ve identified four critical growth strategies that consistently differentiate survivors from casualties.

Customer Development-Led Growth

The most successful industrial technology startups begin with extensive customer discovery rather than product development. This approach involves conducting 10+ problem interviews with potential customers before writing code or developing prototypes. Companies like Slack and Dropbox exemplified this methodology in their early stages, validating market demand before significant development investment.

For industrial technology startups, customer development requires deeper engagement with asset owners, service companies, and technology integrators. These stakeholders often have different priorities and decision-making processes, making comprehensive customer discovery essential for product-market fit.

Land-and-Expand Strategy

Industrial technology adoption often begins with limited deployments that expand over time. Successful startups design modular solutions that allow customers to start small while providing clear pathways for expansion.

This strategy proves particularly effective in industrial settings where risk aversion drives conservative adoption behaviors. Asset owners prefer to validate new technologies in controlled environments before committing to organization-wide implementations.

Partnership-Driven Market Access

Industrial technology markets are characterized by established relationships between asset owners and trusted service providers. Startups that build strategic partnerships with these intermediaries often achieve faster market penetration than those pursuing direct sales approaches.

These partnerships provide credibility, market access, and implementation expertise that startups typically lack. However, successful partnerships require careful alignment of value propositions and revenue models.

Evidence-Based Value Demonstration

Industrial customers demand concrete evidence of value before making adoption decisions. Successful startups invest heavily in pilot programs, case studies, and ROI calculations that provide objective validation of their value propositions.

This evidence-based approach requires patience and significant upfront investment, but it creates sustainable competitive advantages.

Navigating the Current Market Environment

The industrial technology startup landscape presents both unprecedented opportunities and significant challenges. Global spending on digital transformation continues to accelerate, with 91% of manufacturing organizations planning to increase technology investments.

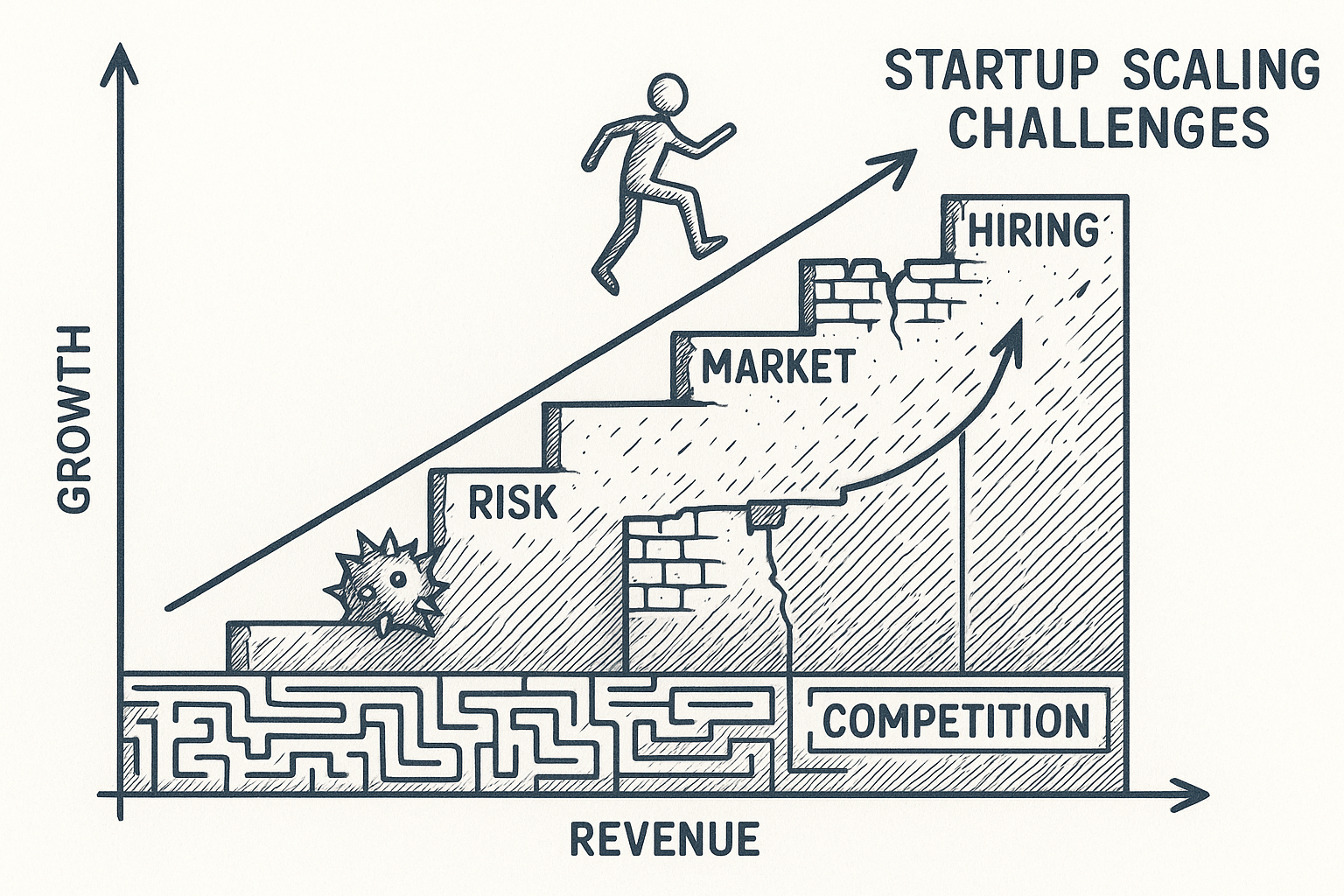

Startup scaling challenges and pathways

However, the funding environment has become more selective, with venture capital focusing on startups that demonstrate clear paths to profitability. This shift favors industrial technology companies that can articulate concrete value propositions and show measurable customer traction.

The rise of AI and automation technologies creates additional opportunities for industrial applications, but also increases competition and customer confusion. Startups must differentiate themselves through deep industry expertise rather than generic technological capabilities.

Building for Long-Term Success

Industrial technology startups that achieve long-term success share common characteristics that distinguish them from their failed counterparts. They maintain laser focus on customer problems rather than technological possibilities, build strong relationships with industry stakeholders, and design business models that align with customer adoption patterns.

These companies also recognize that industrial technology adoption occurs over years rather than months. They build financial models and operational strategies that account for extended sales cycles and gradual market penetration.

Most importantly, successful industrial technology startups challenge conventional wisdom about customer needs while remaining grounded in practical implementation realities. They question established practices and push for transformation, but they do so with deep understanding of operational constraints and risk considerations.

The Path Forward: Transforming Industrial Operations Through Strategic Innovation

The industrial technology startup landscape will continue evolving as digital transformation accelerates across traditional industries. Companies that understand the unique dynamics of industrial markets, extended adoption cycles, high implementation stakes, and relationship-driven decision-making, will find significant opportunities for growth.

The key lies in bridging the gap between technological possibility and operational reality. Industrial asset owners need solutions that deliver transformative value while minimizing implementation risk. Service companies seek technologies that enhance their competitive positioning without disrupting their business models.

For entrepreneurs entering this space, success requires more than brilliant engineering or innovative algorithms. It demands deep industry knowledge, patient capital, and relentless focus on customer value creation. The companies that master these elements will not only survive the brutal startup statistics but will also play crucial roles in transforming industrial operations for the next decade.